All Categories

Featured

Think About Utilizing the cent formula: dollar means Financial debt, Revenue, Mortgage, and Education and learning. Overall your debts, home mortgage, and university expenditures, plus your income for the variety of years your household needs protection (e.g., till the youngsters are out of your house), which's your protection demand. Some monetary experts compute the quantity you need utilizing the Human Life Value viewpoint, which is your life time revenue possible what you're earning now, and what you anticipate to make in the future.

One way to do that is to seek firms with solid Monetary toughness rankings. family income benefit term life insurance. 8A firm that finances its own policies: Some companies can offer policies from an additional insurance provider, and this can add an additional layer if you intend to change your policy or in the future when your family members needs a payout

Can Diabetics Get Term Life Insurance

Some companies provide this on a year-to-year basis and while you can anticipate your rates to climb substantially, it might be worth it for your survivors. Another method to compare insurer is by looking at on the internet consumer testimonials. While these aren't likely to tell you much about a company's monetary stability, it can tell you exactly how very easy they are to collaborate with, and whether claims servicing is a trouble.

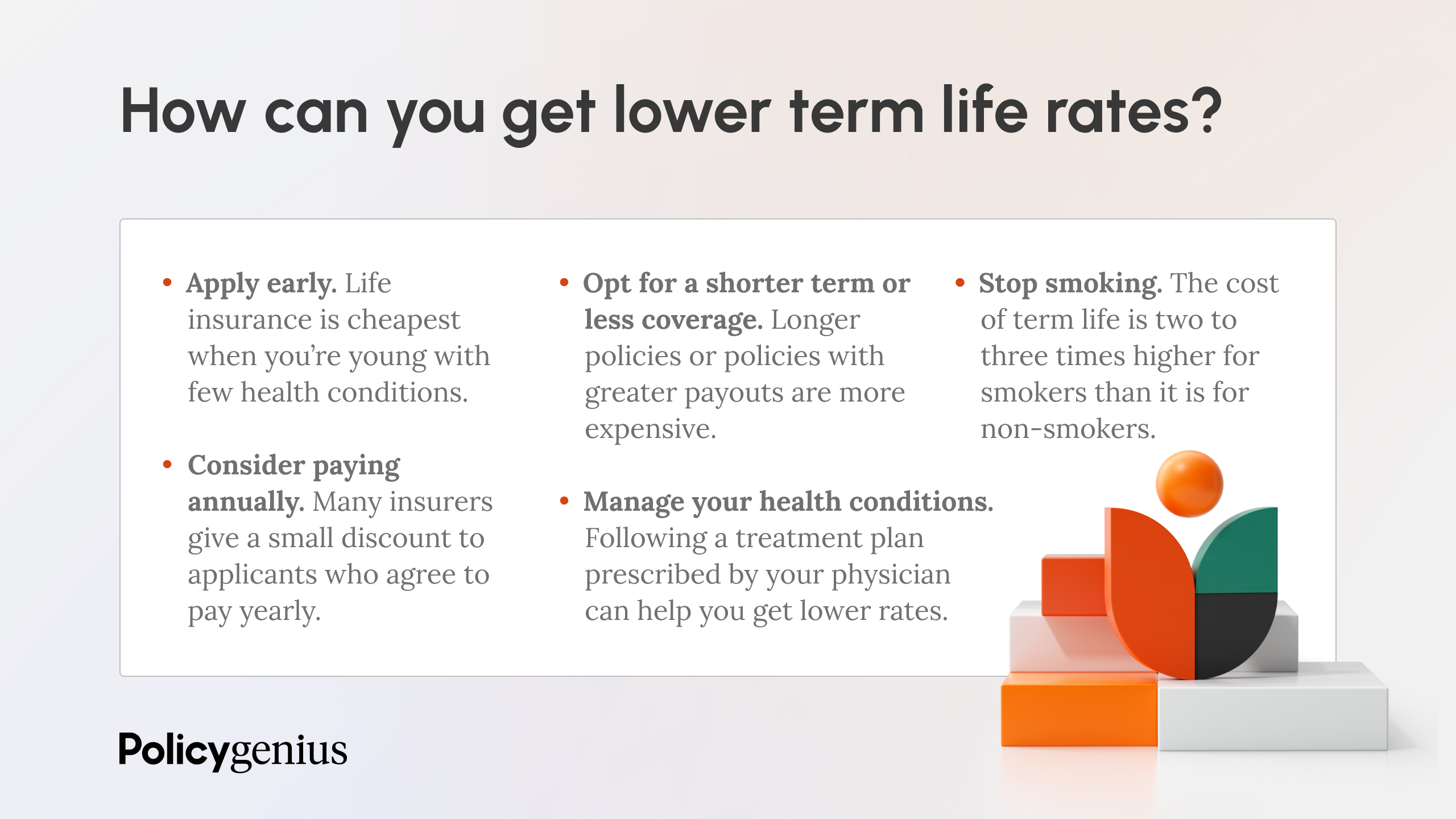

When you're more youthful, term life insurance can be a basic means to secure your enjoyed ones. As life adjustments your financial concerns can too, so you may desire to have entire life insurance policy for its lifetime insurance coverage and additional benefits that you can use while you're living.

Authorization is assured no matter your health. The premiums won't boost once they're set, but they will rise with age, so it's an excellent idea to secure them in early. Learn even more concerning just how a term conversion works.

1Term life insurance policy supplies momentary security for an essential period of time and is usually less costly than irreversible life insurance policy. term to 100 life insurance. 2Term conversion standards and limitations, such as timing, might apply; for example, there may be a ten-year conversion advantage for some products and a five-year conversion benefit for others

3Rider Insured's Paid-Up Insurance policy Purchase Option in New York. There is an expense to exercise this cyclist. Not all participating plan proprietors are eligible for dividends.

Latest Posts

Does Term Life Insurance Cover Accidental Death

Term Life Insurance Vs Universal Life Insurance

A Long Term Care Rider In A Life Insurance Policy